The headline disruption for many software companies in the cloud will be the growth of platform-as-a-service (PaaS) and software vendors need to defend their share by taking a clear look at where they have the best and most defendable opportunities to differentiate themselves, industry experts said.

As PaaS services become more sophisticated, Paul Roche, senior partner at consultancy firm McKinsey, said that software application vendors have a tougher time justifying a price premium for products that could be delivered with a thin user interface on top of generic PaaS services.

PaaS from the big three cloud vendors - Amazon Web Services, Google Cloud, and Microsoft Azure - are gaining share and commoditising software.

Between 2016 and 2018, PaaS revenues grew at nearly twice the rate of SaaS—44% a year versus 26%, respectively.

The big three cloud vendors have seen their revenues grow by a compound annual rate of roughly 65% between 2014 and 2018, compared with just 4 to 5% for SaaS vendors.

McKinsey study revealed that disruptors that pioneered the software-as-a-service (SaaS) model and the incumbents that transitioned to it created tremendous shareholder value in the last 10 years and reshaped the enterprise-software industry.

Between 2011 and 2018, the global software industry’s market cap grew at twice the rate of the overall market but it came with a cost - industry profitability tumbling and falling by half over the decade.

Roche said that SaaS offerings, which commanded just 6% of enterprise-software revenues in 2010, grew to 29% or $150 billion globally by 2018.

When revenues from companies still transitioning to SaaS are counted, he said the total as-a-service share rose to 75% of all enterprise-software revenues or more than $380 billion in 2018, and companies with no SaaS offerings now represent only one-quarter of total industry revenues.

With financial markets reeling from the Covid-19 pandemic, Roche said that investors are looking more closely at bottom-line health.

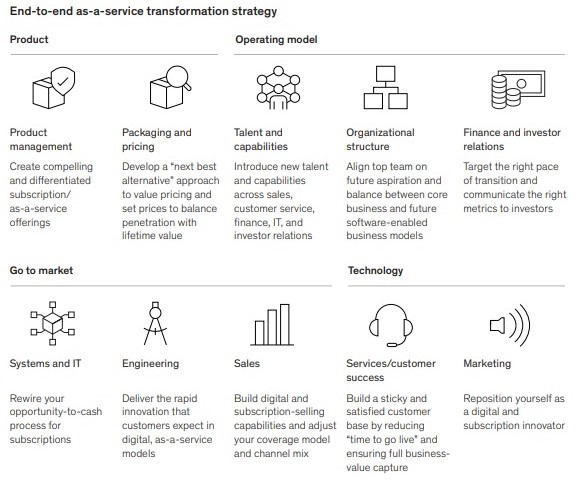

“Addressing these demands will require software vendors to adopt a new playbook. Success will take a renewed strategic focus, a willingness to expand “as-a-service” offerings beyond subscription pricing, and a greater emphasis on profitable growth,” Roche said.

Jeremy Schneider, senior partner at McKinsey, said that vendors that have not yet begun their SaaS transformation must do so now.

“The ‘next normal’ established during the Covid-19 pandemic will accelerate the footprint of SaaS, given the growth of remote working, the rapid deployment of digital solutions, and the lower up-front costs,” he said.

- Why cloud became a de-facto technology in Mideast and Africa during Covid-19

- Will Oracle or SAP win the cloud ERP race in 2020?

- Why technology is critical to success when moving from crisis to recovery phase?

- Cloud apps don't need to be rewritten and to be in same programming language: SAP

Confusing product terminology

To succeed with SaaS, Schneider said that vendors must do more than offer a subscription-pricing model on a product hosted in the cloud.

“They need to match the streamlined, customer-friendly as-a-service product-delivery experience with a similarly streamlined and customer-friendly end-to-end journey. Right now, the customer experience of many SaaS vendors often feels disjointed.

“All too frequently, for instance, legacy billing processes and order forms riddled with confusing product terminology make it hard for customers to know what they’re paying for. Leading players address these inconsistencies by evaluating the whole business in the as-a-service context and redesigning core processes to make them more intuitive and responsive,” he said.

“Much of that growth came at the bottom of the software stack. The big three cloud vendors, with their vast scale and resources, have developed PaaS services that now rival those of the leading software vendors. The reach and financial muscle of the cloud giants allow them to innovate more quickly and to build and maintain these services at a lower cost,” he said.

“With PaaS tools giving attackers and customers themselves the means to develop new applications quickly, software vendors that do not innovate in kind will face increased risk,” he said.

Strategies for SaaS players to differentiate

Rather than going head-to-head with the big three, Tejas Shah, associate partner at McKinsey, said that one strategy is to specialise and tailor solutions to the needs of targeted verticals and use cases.

“This strategy proved successful in the early 2010s when SaaS disruptors first entered the market. The legacy-software vendors that were closest to the customer and had a high degree of industry and domain expertise protected their market share and maintained their enterprise value-to-revenue multiples while customers that stressed differentiation on the basis of their technology were more vulnerable,” he said.

Another strategy, he said is to provide a cloud-agnostic experience for customers.

Fearing cloud lock-in, he said that some software customers are actively searching for application development and delivery (AD&D) and systems infrastructure software (SIS tools) that can work across their cloud deployments.

“Software vendors that meet this need quickly could unlock a value pool that the big three cannot touch. Still, in order to maintain this position, they will have to invest heavily to keep up with the big three’s pace of innovation,” he said.

The third option for vendors, he said is to strike strategic partnerships.

Shah said that the disruption over the past decade proved that many legacy software players are remarkably resilient.

“Vendors will need to call on that resilience to weather the challenges ahead. By revisiting their strategic playbooks, investing in defendable and high-growth opportunities, and embedding smarter and more cost-effective ways of working across the organisation, software vendors can secure a foothold and pave the way for a profitable next decade,” he said.

No comments